Last updated May 2023

The value chain can be divided into several stages.

Mining: Uranium is typically mined from deposits that are found in the earth’s crust. There are several methods of mining uranium, including open-pit mining, underground mining, and in-situ leaching (ISL). The choice of mining method depends on the location and quality of the deposit.

Milling/Processing: After it is mined, the raw ore is typically sent to a milling facility, where it is crushed and processed to extract the uranium. This process generates several waste products, including tailings, which are stored in specially designed facilities. At an ISL mine, the pregnant uranium bearing concentrate will be sent straight to a processing plant, where uranium will be recovered and packed into drums as yellow powder.

Conversion: The extracted uranium is then converted into a form that is suitable for use in a nuclear power plant. This typically involves the production of uranium hexafluoride (UF6), which is a stable compound that can be easily transported and stored.

Enrichment: The UF6 is then enriched to increase the proportion of the isotope U-235, which is the fissile isotope that is used to generate electricity in a nuclear power plant. Natural Uranium always contains 0.711% U-235 with the remainder being the stable isotope U-238. The enrichment process involves separating the U-235 from the more abundant U-238 isotopes and creating a stream of enriched (typically 4-5%) products, while also creating a waste stream depleted in U-235, the so called ‘Tails’.

Fuel fabrication: The enriched UF6 is then de-converted into solid UO2, sintered into fuel pellets, and stacked into fuel rods, which are used to generate electricity in a nuclear power plant. The fuel rods are typically made of a ceramic material, such as zirconium, and are encased in a metal cladding.

Power generation: The fuel rods are loaded into a nuclear reactor, where the fissile uranium isotopes get hit by neutrons, which creates more neutrons and split the uranium. This process generates heat which is used to generate steam to power a turbine, which in turn generates electricity. The used fuel rods are removed from the reactor and replaced with fresh fuel rods.

Waste management: After the fuel rods have been used, they are considered radioactive waste and must be carefully stored and managed. There are several options for managing used fuel rods, including reprocessing and permanent disposal in a geologic repository.

On the demand side, nuclear is a key and growing element in the global clean-energy strategy. With global energy consumption forecasted to nearly double in the next 20 years because of rapid population and economic growth, combined with a drive to carbon-free power, the required baseload power will be provided by nuclear sources.

Uranium will be the fuel source for the expanding nuclear electricity sector. Recent developments in Small Modular Reactor (SMR) technology allow nuclear power to be used for other purposes than electricity generation as well. Water desalination, hydrogen production, and heat generation, to name a few. This is an additional large source of uranium demand in the future.

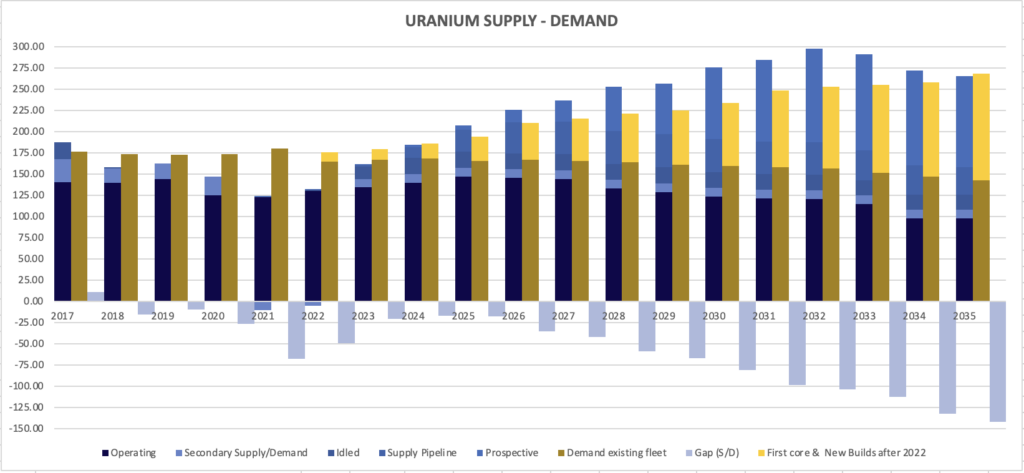

Uranium supply has been depressed for many years as a result of underinvestment in new production capacity because of a low uranium price following the Fukushima accident. Due to the high level of geographical concentration of mines, there is an inherent lag time for new primary supply to come to the market. Supply disruptions due to the COVID pandemic and geo-political tensions have also contributed to uncertain supply.

With the recent demand increase, the net result has been a record deficit since 2020.

The graph shows the rapid build-out of new nuclear, mostly driven by China. The demand does not consider any build-out of Small Modular Reactors (SMR’s) which could further strengthen the demand numbers. The gap analysis only takes into account existing mine production, secondary supply, and returning idled mines, but not mines that are in the supply pipeline or prospective. The analysis shows sufficient mining resources are available, but that the uranium market is heavily exposed to new mining projects delivering on time and on budget.

Last updated May 2023

Curzon is one of the world’s leading innovators at the heart of the global nuclear renaissance.

Curzon Uranium Ltd.

Griva Digeni 81-83, Jacovides Tower, Office 106

1090 Nicosia

CYPRUS

© All Rights Reserved.